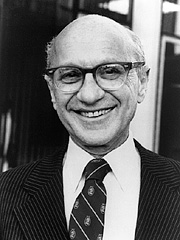

Milton Friedman, 1912-2006

We have just learned of the death today of Milton Friedman. Friedman’s contributions to economics and the public economic policy of the United States were extraordinary. Stephen Chapman wrote in the Chicago Tribune: “It is a rare professor who greatly alters the thinking of his professional colleagues. It’s an even rarer one who helps transform the world. Friedman has done both.”

We have just learned of the death today of Milton Friedman. Friedman’s contributions to economics and the public economic policy of the United States were extraordinary. Stephen Chapman wrote in the Chicago Tribune: “It is a rare professor who greatly alters the thinking of his professional colleagues. It’s an even rarer one who helps transform the world. Friedman has done both.”

Friedman’s analysis of the Great Depression transformed not only our understanding of the causes of the economic turmoil of that era, but current monetary policy as well. The policies of the Federal Reserve Bank are guided by Friedman’s theories on the linkage between inflation and the money supply. His analysis of currency markets prompted the practice of floating exchange rates. He was a principal founder of what has come to be known as the Chicago School of Economics. He was, as well, a great public champion of laissez-faire capitalism, influencing the economic policy decisions of every U.S. president of the last 30 years, as well as economic policy in governments around the world. Friedman won the Nobel Prize in Economic Sciences in 1976.

In 1962 we published Capitalism and Freedom one of the most influential books, in any subject, of the past 50 years. In 1998 we published Two Lucky People, the memoir by Milton and Rose Friedman of their joint lives and work. In reviewing the book in the New York Times Book Review, David Brooks wrote: “This is a book that restores your faith in reasoned discourse.… There really are people who believe in scholarly exchange as a way to discover truth.”

We also published Essays in Positive Economics (1953), Studies in the Quantity Theory of Money (1956), and Milton Friedman’s Monetary Framework: A Debate with His Critics (1976).

More information should be available soon from the University of Chicago News Office.