Review: Goldgar, Tulipmania

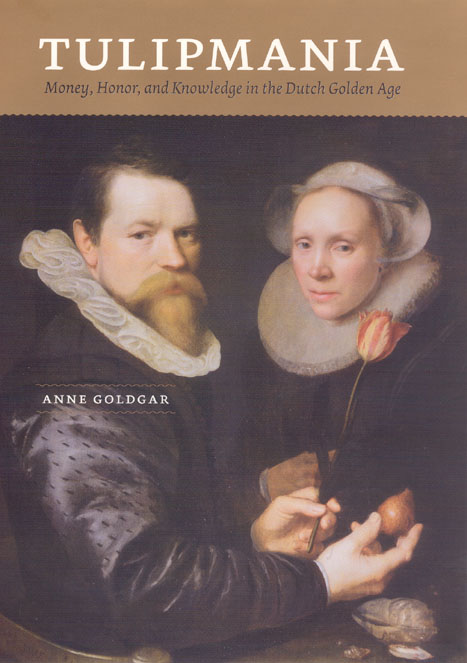

The May 12 Financial Times ran an interesting review of Anne Goldgar’s new book, Tulipmania: Money, Honor, and Knowledge in the Dutch Golden Age. Simon Kuper writes for the FT:

We think we know the story of “tulipmania”: the 17th-century Dutch dropped fortunes on tulips, ruined their economy, even killed themselves over the bulbs. In short, tulipmania is remembered as the first market bubble. It has been used as an analogy for subsequent ones, most recently during the dotcom boom. However, Anne Goldgar tells us at the start of her excellent debunking book: “Most of what we have heard of it is not true.…”

The bubble grew from late 1636.… Prices of Switsers bulbs, to cite one example, rose 12-fold from new year of 1637 to peak on February 3 at 1,500 guilders a pound.… The crash came in early February 1637, when prices fell by approximately 90 per cent.… Yet the effects were modest. It’s a myth that tulipmania devastated the Dutch economy. How could it, when so few people traded tulips? Even those who did survived the crash. Tulips were merely a sideline to their real professions. Rather, tulipmania damaged the code of honour that underlay Dutch capitalism. When buyers reneged, trust suffered. Tulipmania was a social crisis, not a financial one, argues Goldgar.

To read the rest of the review head over to the Financial Times website. We also have an excerpt from the introduction to the book.